BSI’s fourth Organizational Resilience Index identifies a clear link between holistic Organizational Resilience and financial performance, with 57% expecting a stronger 2021

March 15, 2021

Despite the challenges of 2020, business leaders’ confidence in the resilience of their organizations has risen, according to BSI’s fourth annual Organizational Resilience Index report, which surveyed 500 senior leaders across the globe.

The index found that leaders remain cautiously optimistic, with more than half (57%) of businesses in the UK, US, and India expecting their financial performance to improve this year. The concept of Organizational Resilience refers to an organization’s ability to anticipate, prepare for, and adapt to both incremental change and sudden disruptions in order to survive and thrive - capabilities that have been put to the test in the past year.

As a whole, perceived Organizational Resilience across organizations globally rose in 2020, with a third of firms (33%) fully confident in the resilience of their organizations - five per cent more than in 2019. Encouragingly, many of the organizations interviewed felt that the measures they had in place prior to the pandemic were successful and helped them survive, stabilize and begin to rebuild, boosting their confidence for the future.

While 2020 was a difficult year for most, many organizations emerged more confident from the test of the pandemic. Within the study, there is a clear association between those reporting a stronger financial performance and those with stronger perceptions of their own Organizational Resilience.

Susan Taylor Martin, Chief Executive of BSI commented:

“2020 was a global test of Organizational Resilience and powerfully demonstrated the increasing importance of an organization’s ability to prepare for, and respond to, unexpected or sudden disruption. It’s encouraging to see cautious optimism about the future as business leaders focus on building back better and organizations clearly recognize the value of prioritizing the health, safety and wellbeing of employees, clients, and communities.

“As we look ahead to the ‘next normal,’ we hope that our annual Organizational Resilience Index benchmark continues to provide organizations with the insights, foresight, and inspiration to seize opportunities ahead and ensure their businesses remain resilient in the future.”

Whilst global recovery will be variable and take place at different rates around the world, the index found that financial security and confidence is not evenly spread globally. Despite businesses in Japan and China reporting similar financial setbacks in 2020, only organizations in China expect a better year in 2021. Respondents suggested that this slower return to confidence in Japan is reflective of business culture rather than market conditions.

Business leaders in India, the US, and the UK are looking ahead with relative optimism, with future confidence in their organizations either doubling or trebling, despite nearly half of organizations reporting worse year-on-year financial results in 2020.

Japan had the largest proportion of organizations reporting a worse year in 2020, and is forecasting the weakest recovery with only 38% expecting a better year in 2021. In contrast, US firms were the least likely to report a reversal of fortunes in 2020, and, alongside India, are the most likely to forecast growth with 64% expecting a stronger 2021.

The report identifies that the Aerospace industry is least confident of its Organizational Resilience following the upheavals of 2020; just 43% expect an improvement in 2021 in contrast to 67% of business leaders in the Built Environment, 61% in Healthcare, 57% in Food and 56% in Automotive.

Despite the upheaval caused by the COVID-19 pandemic, Diversity and Sustainability continue to remain high on the agendas of organizations worldwide. The report found that - rather than shifting down the priority list due to the emergence of matters that were perceived to be more urgent - looking after the wellbeing of employees, customers and communities was vital for rebuilding Organizational Resilience.

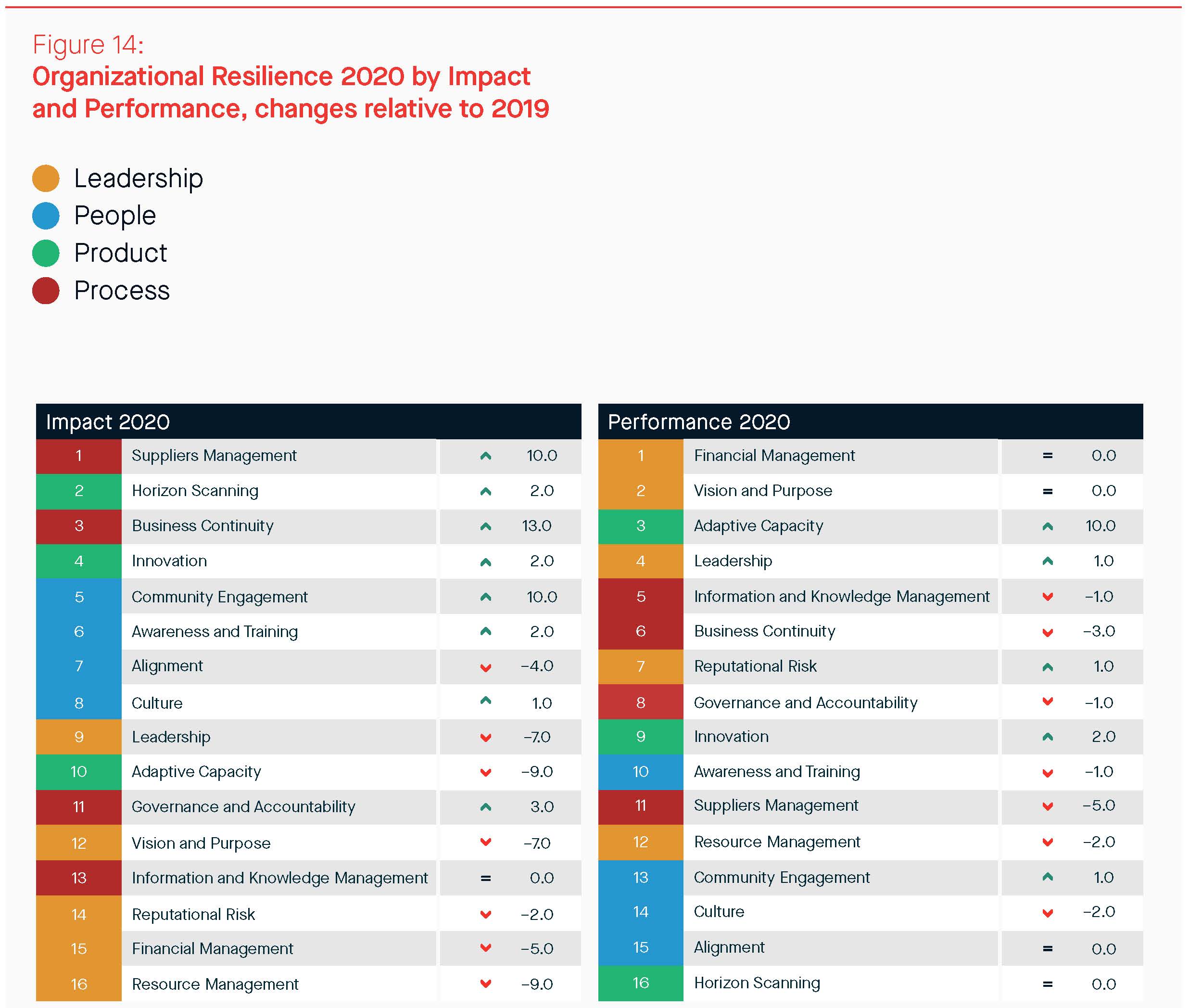

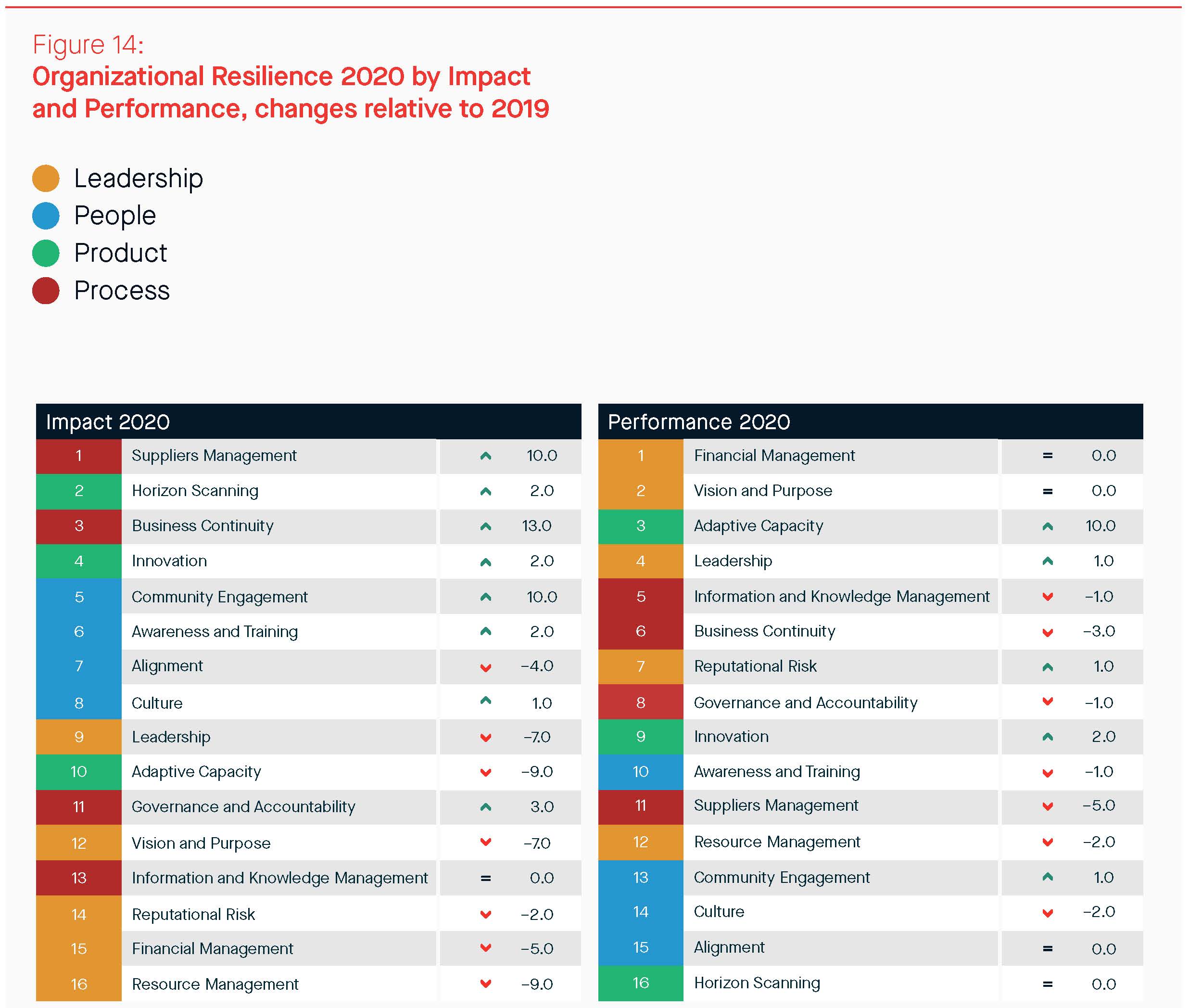

Of the 16 elements that make up Organizational Resilience, the report found that the most and least important are (+/- numbers denote annual move in rank):